Bitcoin has revolutionized the financial world by introducing a decentralized, peer-to-peer digital currency that operates without banks or central authorities. At the heart of this innovation lies bitcoin mining, a process that verifies transactions and secures the blockchain through an energy-intensive system known as Proof-of-Work (PoW). But why exactly does bitcoin mining use so much energy, and is this consumption wasteful or essential?

In this article, we’ll break down how Bitcoin’s energy use works, why electricity is vital to its security model, and the misconceptions surrounding its environmental impact. We’ll also explore how Bitcoin compares to other industries, the role of renewable energy in mining, and whether alternative consensus mechanisms could reduce its energy footprint.

How Proof-of-Work Keeps Bitcoin Secure

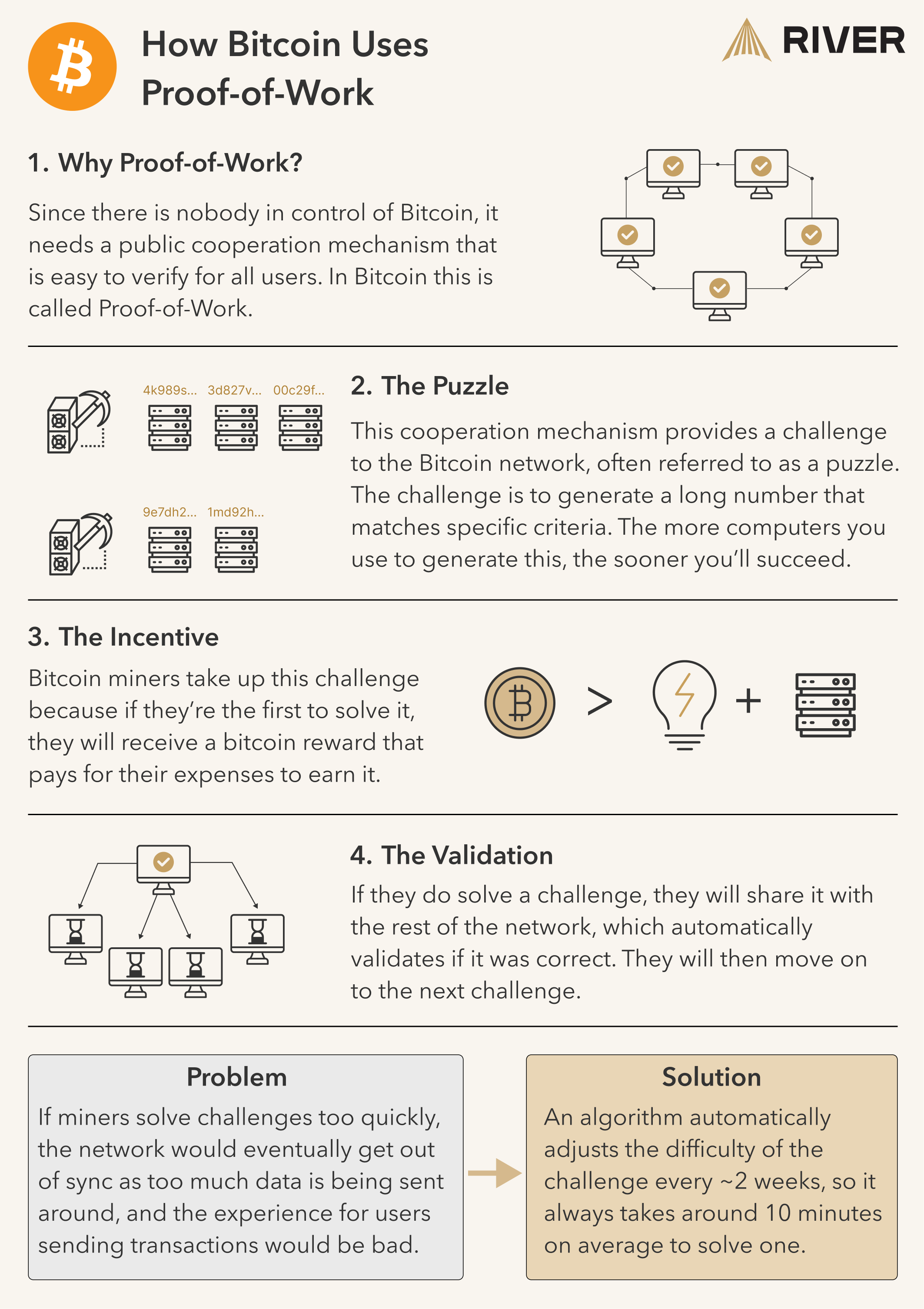

At the core of Bitcoin’s security and decentralization is its Proof-of-Work (PoW) consensus mechanism. Proof-of-Work requires miners (specialized computers running powerful hardware) to compete in a race of brute-force guessing to find a valid cryptographic hash. This process makes it extremely costly to manipulate the blockchain, ensuring that new blocks of transactions are securely added and network integrity is maintained.

➤ Learn more about Bitcoin mining.

In exchange for the massive amount of computational power and electricity used, miners are rewarded with the block reward—currently 3.125 new bitcoin—along with the transaction fees from the payments included in that block.

Proof-of-Work works because it’s expensive. Miners have to spend real money (electricity and hardware) to add blocks. If someone tried to change even one transaction, they’d have to redo all that work for every block after it, which would cost an enormous amount of time and energy. This enormous expense is what prevents fraud and guarantees the immutability of Bitcoin’s ledger.

By anchoring security in physical energy and computation, Proof-of-Work ensures that Bitcoin remains resistant to censorship, manipulation, and central control, qualities that traditional financial systems struggle to provide.

Bitcoin’s Electricity Usage

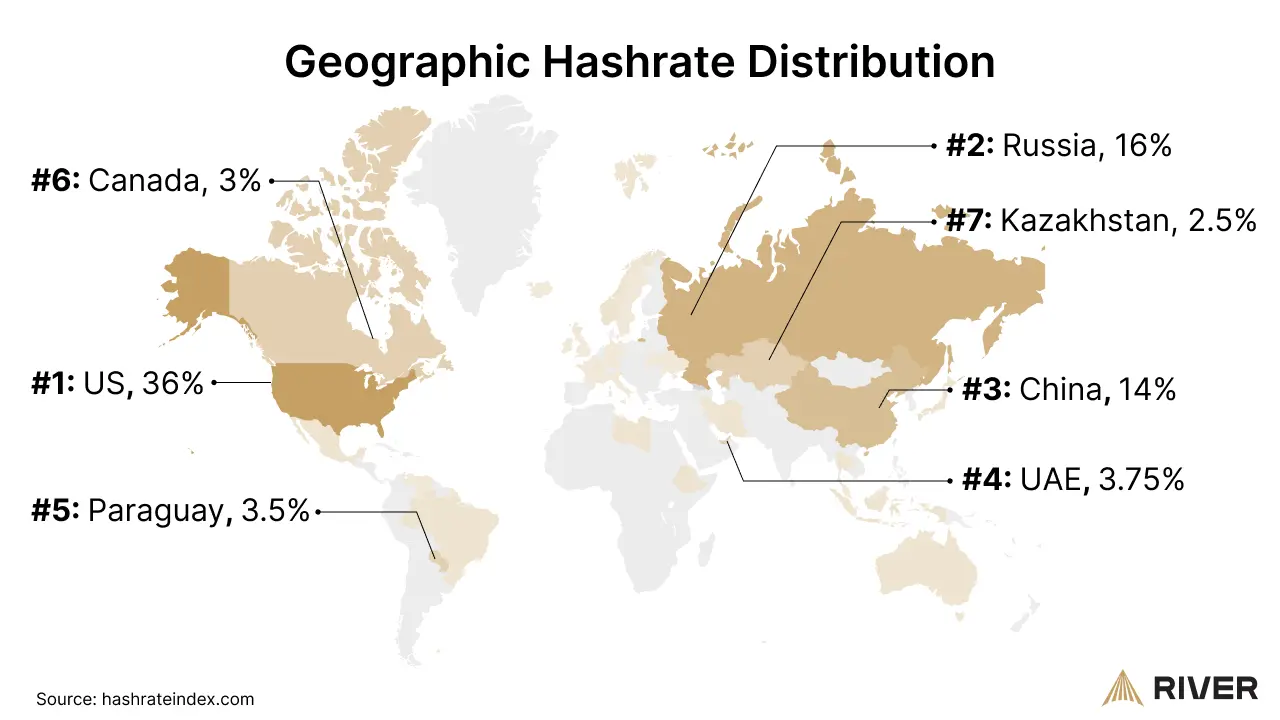

The Bitcoin Network is composed of thousands of miners located across the globe. Mining blocks and the Proof-of-Work consensus algorithm require significant electrical energy. According to the Cambridge Bitcoin Electricity Consumption Index, Bitcoin’s daily power demand was estimated at about 22.52 gigawatt hours (GWH) as of August 20, 2024.

The map below shows how bitcoin mining is distributed by country, as measured by hashrate.

People who claim Bitcoin is wasteful rarely use Bitcoin themselves, but there are tens if not hundreds of millions of people around the world who rely on Bitcoin to preserve the value of their savings and do permissionless transactions. These use cases make it valuable to people, and thus make the network worth protecting. The best way thousands of developers have found to protect a decentralized network is through proven energy consumption, as it ensures that the currency cannot be created out of thin air or manipulated by centralized authorities.

Because of Proof-of-Work and mining, Bitcoin represents one of the simplest and most direct transformations of energy into value. Just as gold requires the expenditure of labor and resources to mine from the earth, Bitcoin requires energy to “mine” in the digital realm.

How Much Energy Does Bitcoin Use per Transaction?

A common question people ask is: how much energy does one Bitcoin transaction use? While it sounds straightforward, this question doesn’t actually make sense within Bitcoin’s design. It stems from two major misconceptions about how Bitcoin’s energy consumption works:

Misconception #1: Bitcoin Uses Energy Only to Process Transactions

Bitcoin miners don’t consume energy just to process individual payments. Instead, their computational work secures the entire historical record of bitcoin transactions, ensuring that no one can alter the blockchain. New transactions are bundled into blocks during this process, which creates the illusion that energy is being spent directly on transaction processing.

Bitcoin’s energy use is about protection and security, not transaction throughput. A useful analogy is the traditional banking system: processing a credit card transaction at a store takes little energy, but keeping global payment networks safe from fraud, theft, and cyberattacks requires enormous resources. Bitcoin simply concentrates this protective effort into its Proof-of-Work system.

2. Misconception #2: Bitcoin’s Energy Use Grows With Every Transaction

Another misconception is that Bitcoin’s energy usage automatically scales with the number of transactions. In truth, two main factors determine the network’s overall energy consumption:

- Mining Costs and Profitability: Miners add computing power as long as it remains profitable. If competition grows and mining becomes too costly (for example, due to high electricity prices), less efficient miners shut down. Bitcoin’s built-in difficulty adjustment ensures that block production always averages around 10 minutes, balancing energy use over time.

- Bitcoin Price: The higher the price of bitcoin, the more incentive miners have to secure the network, since rewards (block subsidies + fees) become more valuable. Conversely, when prices fall, many miners reduce operations unless they have access to ultra-cheap energy.

Bitcoin is gradually turning into a settlement layer, where one transaction on the blockchain can represent multiple, even thousands of transactions that were made on secondary layers. For example, our 2023 Lightning Report estimates that the Lightning Network enables around 165 transactions for each one recorded on the blockchain. This creates significant efficiency and makes simple “energy per transaction” estimates less meaningful over time.

Rather than focusing on energy per transaction, the more relevant question is: how much energy does the Bitcoin network use in total, and what value does that energy secure?

How Much Energy Does Bitcoin Use in Total?

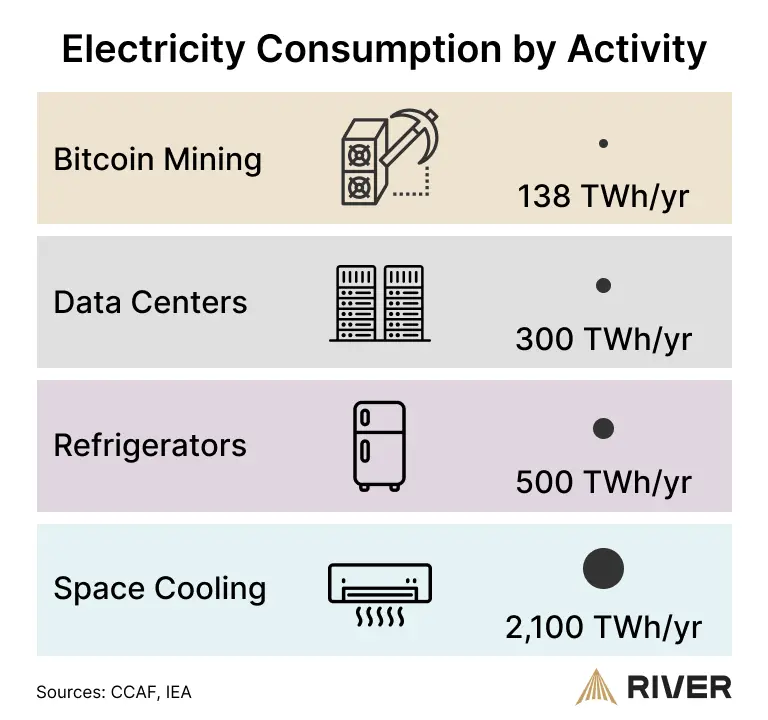

An April 2025 report from the Cambridge Centre for Alternative Finance (CCAF) states that Bitcoin mining consumes approximately 138 TWh per year, which represents about 0.54% of global electricity consumption.

To understand this figure, it helps to compare it with other familiar activities and industries. Refrigerators, data centers, and everyday conveniences such as air conditioning all consume substantial amounts of energy. These activities are valued differently by different people, but they highlight an important point: society routinely dedicates significant energy to things it considers meaningful.

Bitcoin’s Use of Renewable and Sustainable Energy

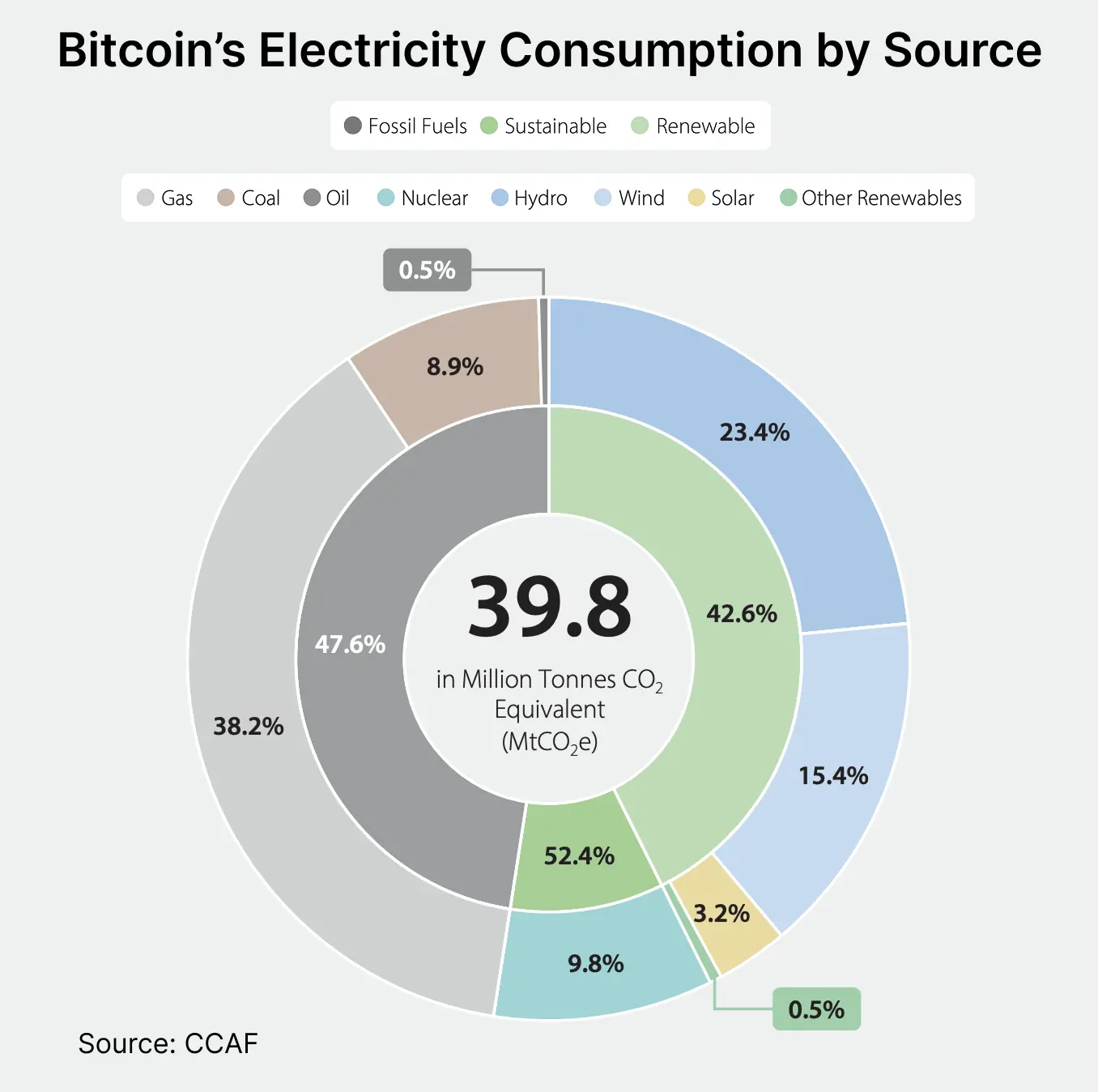

According to the CCAF, about 52.4% of Bitcoin mining’s energy consumption now comes from sustainable sources. This includes 42.6% from renewable energy such as wind, solar, and hydro, along with 9.8% from nuclear power, which is also zero-emission.

This shift is no accident. In many remote areas, renewable energy is abundant but underutilized because local demand is too small to justify large-scale infrastructure. For instance, hydroelectric dams in sparsely populated regions often generate more power than nearby communities can consume. By stepping in as a flexible and mobile energy buyer, bitcoin miners turn this surplus into economic value.

Projects like Gridless in Africa show how this can have lasting community benefits. By purchasing excess renewable power, miners help utilities recover their investment costs faster. Once those costs are paid off, electricity becomes cheaper for local households and businesses. In this way, bitcoin mining doesn’t just use renewable energy, it can accelerate its adoption and make clean power more affordable for everyone.

Could Bitcoin Switch to a Less Energy-Intensive Consensus Mechanism?

In theory, Bitcoin could change its consensus algorithm to one that uses less energy, such as Proof-of-Stake (PoS). PoS is the most widely researched alternative to Proof-of-Work and has been adopted by other blockchains. However, the overwhelming majority of Bitcoin participants reject this idea due to the serious risks it introduces.

The largest concern is centralization. Proof-of-Work relies on open competition powered by energy, but Proof-of-Stake relies on ownership of coins. In PoS, instead of miners expending energy to create blocks, participants, called stakers, lock up their coins and “vote” on the correct version of the blockchain. If they act dishonestly, they lose part of their stake; if they act honestly, they earn newly minted coins.

In practice, this means that the more coins a participant already owns, the greater their influence over transaction processing and future rewards. Over time, this can lead to extreme concentration of power in the hands of a few wealthy stakeholders. Many Bitcoin advocates argue this resembles the traditional financial system, where influence comes from capital ownership, rather than offering a truly decentralized alternative.

➤ Learn more about Proof-of-Work vs. Proof-of-Stake.

Could Bitcoin Miners Solve Useful Problems?

A common question newcomers ask is whether Bitcoin miners could direct their computational power toward solving other problems that are socially useful, such as AI or scientific simulations. At first glance, this might seem like a more “productive” use of energy. However, Bitcoin’s design intentionally avoids this approach to preserve security and decentralization.

The reason is simple: when miners create a block, they must present a solution to the network that can be instantly verified by every node. The Proof-of-Work system is built around this idea of easy verification. If miners were instead tasked with problems like protein folding (a process used to study how proteins form, which has implications for disease research), the network would face a paradox: in order to verify the solution, nodes would need to have already computed it themselves. That defeats the purpose, making the process inefficient and wasteful all over again.

Another critical issue is fairness. If one organization were able to supply the “useful” problems to the network, they would gain an enormous advantage by knowing in advance what computations would be required. This would undermine Bitcoin’s open, permissionless nature and concentrate mining power in the hands of a few.

In short, bitcoin miners cannot and should not be repurposed for unrelated computational tasks. Their sole purpose is to run Proof-of-Work, ensuring that Bitcoin remains trustless, decentralized, and resistant to manipulation. The fact that their work has no other application is not a flaw, it is a deliberate design choice that protects the integrity of the entire system.

Key Takeaways

- Bitcoin mining uses energy to secure the entire history of transactions.

- The energy cost makes it immensely expensive for bad actors to do anything meaningful.

- Bitcoin is powered by a higher % of renewable energy than any highly developed country.